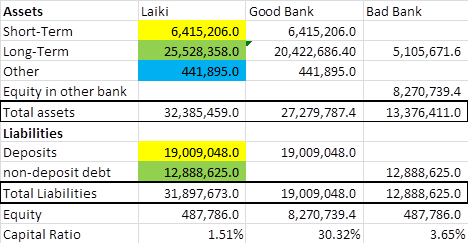

The above is Laiki’s(Cypriot bank to be bailed out) balance sheet, which I pulled off their latest annual statement. I highlighted the assets which are safe in yellow, the assets which are risky in green and the “other” in blue.

I then highlighted the liabilities which we are trying to protect, the deposits, in yellow, and the liabilities which we don’t in want to safeguard in green. I then added those up in 3 categories of assets and 2 categories of liabilities the result is the column on the left in the picture below.

I then give all the safe/liquid assets to the good bank along with an optimistic portion of long-term which will be paid back. It is likely the majority of these are loans to Greeks which are unsafe and will probably not be paid back in full, so I assumed an 80% repayment rate, which might be optimistic, but the approach also works with less optimistic repayment rates, the difference being the good bank’s capital ratio, the capital ratio and the repayment rate are positively correlated.

Assets

Essentially all of the liquid assets are given to the good bank and all the illiquid ones to the bad bank (in practice this would include some headquarters to continue with their remaining operations). The biggest asset for Laiki is the “advances to customers” this will have to undergo special evaluation for the split between liquid and illiquid to occur. The most important aspect here is that the bad bank holds the equity of the good bank, note that this means that the capital ratio for the bad bank remains fixed no matter how many assets are given to the good bank, nevertheless the good bank should have a maximum amount of liquid assets to ensure safety.

Liabilities

The only liability the good bank needs to take on is the customer deposits since it is what we are trying to protect and it is what prevents us from allowing them to declare bankruptcy. Once the deposits have been secured, capitalism can work again.

Equity

Both the old Laiki equity and the good bank Laiki equity are given to the bad bank.

What this achieves:

1) The Deposits are safe and danger of a bank run is eliminated

2) Remaining debt that was never promised a government guarantee goes to the bad bank.

3) The old Laiki (bad bank) is still relatively better capitalized but still responsible for the decisions they made. If they do become insolvent they can declare bankruptcy without interfering with customers deposits, this means they can now be treated as a normal company.

4) It’s important to highlight that this approach is not complementary(though it can be) to a bailout but a substitute, which does guarantee that bankers will not be over or under punished but will bear the fruits of their actions.

In practice

The good bank will continue to work under the Laiki brand and continue its operations just like normal whilst the bad bank will be running in the background trying to properly manage its existing assets. It will still benefit from profitable activity from the good bank but will be treated like a normal company. No public money (excluding any administrative costs to make this plan work) has been used and stability has been restored. Over time the good bank can also engage in secondary market trading and that can still follow the shareholder’s wishes and should the good bank face a similar crisis that Laiki is facing then the process can be renewed with a new good bank and the old good bank transformed into a new bad bank.

A pre-requisite for this approach to work is that there are sufficient safe assets, and a minor risk this mechanism faces is that banks will no longer favour liquid assets as to not allow this mechanism to work and force a bailout. This is however an extreme scenario that would not occur with properly executed regulation.

This innovative approach has been very well received academically but has not been applied anywhere yet.